Life has a way of throwing surprises at us. Sometimes, those surprises come in the form of health problems, injuries, or recovery journeys that need a little extra help. One of those helpers is EMS—Electronic Muscle Stimulation. You may have heard about it from a doctor, physiotherapist, or maybe even a friend going through rehab.

But here’s a common question many people ask: Is EMS covered under Indian health insurance plans?

This article is here to give you all the answers.

We’ll explore how EMS works, why it’s used, who needs it, and most importantly—whether insurance in India helps you pay for it. We’ll keep everything easy to understand. No big, confusing words. Just real, honest help.

Let’s dive in.

What is EMS and Why is it Used?

EMS: Not Just for Fitness

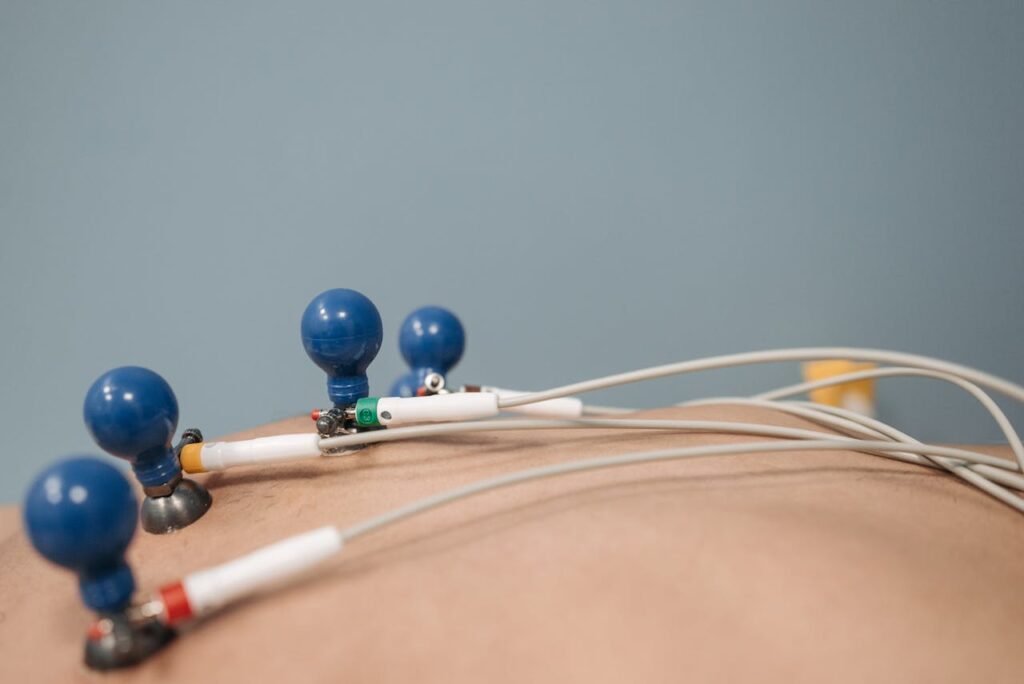

You may have seen EMS devices used in gyms or by athletes. They wear small pads on their skin that send tiny electric pulses to muscles. This makes the muscles contract and relax.

But EMS isn’t just for sports or fitness. It’s also a powerful tool in medical care.

EMS in Medical Rehabilitation

Doctors and physiotherapists often use EMS for patients who have weak muscles after surgery, injury, or illness. The electric signals help “wake up” those muscles. This helps rebuild strength and improves movement.

It’s also used to reduce muscle pain and swelling. Some patients even use EMS at home, under guidance, as part of a recovery plan.

Who Can Benefit From EMS?

Many people. Here are just a few examples:

- Stroke survivors who lost muscle control

- Amputees getting used to a new prosthetic limb

- People recovering from bone fractures

- Patients with muscle weakness due to long bed rest

- Individuals with neurological conditions like multiple sclerosis

In these cases, EMS becomes more than a gadget. It becomes a lifeline. Something that helps people move again, live better, and heal faster.

Is EMS Safe?

Yes, when used correctly.

A doctor or physiotherapist will usually guide how and when to use it. There may be a few side effects like mild tingling or skin irritation, but most people do just fine. The key is proper use, at the right time, with expert advice.

Now that we know what EMS is, let’s see how Indian insurance companies treat it.

How Indian Health Insurance Works

Basic Idea of Health Insurance

Health insurance is a plan you buy to help cover medical costs. You pay a small amount every year (called a premium), and the insurance company promises to pay part or all of your hospital bills if something goes wrong with your health.

But not all plans cover everything. Some plans only cover hospital stays. Others may cover certain treatments, tests, or surgeries—but not all.

Different Types of Health Insurance in India

India has many types of insurance plans. Some common ones include:

- Individual health plans

- Family floater plans

- Group health insurance (usually given by employers)

- Government health schemes like Ayushman Bharat

- Critical illness insurance

Each plan has its own list of what it includes and what it doesn’t.

What is Typically Covered?

Most health insurance plans in India cover:

- Hospital stays (in-patient care)

- Surgeries

- Diagnostic tests done in hospitals

- Doctor fees during hospitalization

- Pre- and post-hospitalization costs (for a limited time)

But here’s the catch—treatments that don’t need hospital stays are sometimes not covered. These are called “OPD” or Outpatient Department treatments.

And EMS often falls in this tricky zone.

Is EMS Considered a Medical Treatment or a Wellness Tool?

EMS in a Hospital Setting

When EMS is part of a formal physiotherapy plan after surgery, and it’s done inside a hospital or rehab clinic, insurance is more likely to cover it. That’s because it becomes part of your post-surgery care.

For example, if someone has knee surgery and then needs EMS therapy at the hospital for three weeks, that EMS might be included in the insurance coverage under post-hospitalization expenses.

EMS at Home or in Fitness Centers

But if EMS is used at home or in a wellness center, it’s often not covered. Insurance companies may see it as a personal or fitness expense, not a medical one.

Some insurance companies call this “preventive care” or “lifestyle use,” and they usually don’t pay for it.

Medical Use vs. Cosmetic Use

Here’s a simple way to understand it: Insurance mostly covers EMS when it is used for recovery, not for improvement.

So, EMS for helping someone walk again? Covered.

EMS for toning your tummy at home? Not covered.

What Insurance Companies Say About EMS

Every insurance company in India has its own rules. But we looked at what some of the biggest ones say.

Case-by-Case Basis

In many cases, EMS is not clearly listed as covered or not covered. Instead, it falls into a “case-by-case” category. This means the company decides based on the doctor’s notes, your medical records, and how the EMS is being used.

If it’s recommended by a doctor for rehab, and it’s part of hospital-based physiotherapy, you may get some coverage.

If you just buy an EMS machine on your own, without a doctor’s note, chances are slim that insurance will pay for it.

Need for Documentation

To get insurance to approve EMS, you usually need:

- A written recommendation from your doctor

- A medical diagnosis showing the need for rehab

- Proof that the EMS is part of a physiotherapy program

- Bills from a recognized hospital or rehab center

The more medical evidence you give, the better your chances.

EMS Coverage in Government Health Schemes

While private health insurance is common in urban areas, many people across India rely on government-supported health plans. Let’s see how EMS fits into those.

Ayushman Bharat (PM-JAY)

Ayushman Bharat, also called PM-JAY, is the largest government health insurance scheme in India. It covers over 50 crore people and focuses on giving free healthcare to the poor and vulnerable.

Under this scheme, hospital treatment is usually fully covered, including some post-surgery rehab.

But EMS is not clearly listed as a covered treatment in public documents. If EMS is done as part of a registered physiotherapy session inside a government hospital, there’s a small chance it may be included. But this varies from one hospital to another and is not guaranteed.

State-Level Schemes

States like Tamil Nadu, Andhra Pradesh, Maharashtra, and Kerala have their own health insurance programs. These also tend to focus on essential treatments and hospitalizations.

So far, none of these schemes clearly list EMS as a standard covered benefit. However, like Ayushman Bharat, they may cover it indirectly if it’s part of rehab after surgery.

In short, coverage is limited—and mostly possible only within a government hospital with proper medical recommendation.

EMS Coverage in Corporate and Group Insurance Plans

What Do Companies Usually Offer?

Corporate health insurance plans are usually group policies that cover employees and sometimes their families. These are usually better than basic individual plans, with broader coverage and fewer restrictions.

But even here, EMS is not a common feature.

EMS in Post-Surgery Rehab

If an employee has surgery and needs hospital-based rehabilitation with EMS, it might be covered as part of the total recovery package.

However, EMS done at home, or without any hospitalization, is still rarely covered—even in premium corporate plans.

Talk to the HR or Insurance Provider

If you have insurance from your company, it’s worth asking HR or the insurance helpdesk if EMS is covered in your specific case. You might be surprised—some top-tier plans do offer outpatient physiotherapy sessions with EMS as part of the benefit.

But always ask for it in writing, or at least in a clearly explained policy document.

How to Improve Your Chances of Getting EMS Covered

1. Get a Clear Medical Diagnosis

First, visit a certified doctor or physiotherapist. You need a proper medical report showing why EMS is required. This should clearly mention:

- Your condition

- The stage of recovery

- Why EMS is important

- How long you’ll need it

This is your first step in proving EMS is not a luxury—it’s a medical need.

2. Get a Written Recommendation

Ask your doctor to write a detailed recommendation for EMS. It should include the purpose (muscle rehab, pain relief, post-surgery recovery, etc.) and how it will help you get better.

The more detailed the letter, the stronger your claim.

3. Use Recognized Clinics or Hospitals

Use EMS therapy only through recognized hospitals or physiotherapy centers. Insurance companies are more likely to approve claims from verified healthcare providers than from unverified clinics or online shops.

If you can, get a bill that includes the term “physiotherapy” or “rehabilitation” along with EMS.

4. Include it as Post-Hospitalization Care

If you’ve had surgery or a long hospital stay, check your policy’s post-hospitalization cover. Most policies allow 30–90 days of care after discharge.

Try to include EMS as part of this window. This gives you a better shot at reimbursement.

5. Keep All Bills and Reports

Every single paper matters. Keep all bills, reports, and doctor notes. When submitting your claim, make sure everything is attached.

If there’s any gap in documentation, the insurance company can reject the claim.

What to Do If Your EMS Claim is Rejected

Step 1: Ask for the Reason

First, ask the company why the claim was denied. They have to give you a reason in writing. It might be due to missing documents, unclear recommendation, or policy terms.

Step 2: Get Help From Your Doctor

Take that rejection letter to your doctor or physiotherapist. Ask them to write a fresh letter explaining again why EMS was essential.

This can help you appeal the decision.

Step 3: File a Formal Appeal

Most insurance companies allow you to appeal a rejected claim. Write a simple letter, attach all fresh documents, and submit again.

If the company still says no, you can also contact the Insurance Ombudsman. This is a free service that helps customers when insurance claims are unfairly denied.

Real Stories: When EMS Was Covered

Case 1: Post-Knee Surgery Rehab

Ravi, a 45-year-old from Pune, had knee replacement surgery. His doctor suggested EMS-based physiotherapy for three weeks after discharge.

The therapy was done at a hospital rehab center, and the doctor gave a full report. The insurance covered it under “post-hospitalization physiotherapy.”

Case 2: Stroke Recovery with EMS

Meena, a 60-year-old teacher from Chennai, had a mild stroke. She couldn’t move her left arm well.

Her neurologist prescribed EMS sessions at a stroke rehab clinic. Because she had a premium individual plan that covered outpatient care, her EMS sessions were fully reimbursed.

Case 3: Rejection Due to Home Use

Sahil, a fitness trainer from Delhi, bought an EMS device online to help with muscle recovery. He submitted the invoice for reimbursement.

The claim was denied because there was no medical prescription or hospital link. His insurance plan didn’t support personal-use EMS.

How Businesses Can Strategically Promote EMS in a Health Insurance-Limited Environment

EMS is growing fast in India. But with limited insurance coverage, clinics and rehab centers often face a common problem: how do you convince patients to commit to EMS therapy when they may have to pay out of pocket?

The answer lies in strategy. If you’re a healthcare provider, business owner, or prosthetic center offering EMS services, this section is for you.

Let’s talk about how you can build trust, improve adoption, and grow your EMS services even when insurance doesn’t always support it.

Focus on Education First

Most patients—and even many doctors—don’t fully understand EMS. They think it’s a fancy fitness tool or something only athletes use. Break that myth.

Use every chance to explain that EMS is a medical-grade tool when used under clinical guidance. Highlight its role in recovery, strength-building, nerve re-activation, and pain reduction.

Make simple handouts, videos, or blog articles. Host awareness sessions in hospitals or housing societies. Share real patient success stories (with consent). Focus less on the machine and more on the outcome—how people get back to work, move better, and regain independence.

When patients understand what EMS really does, they are far more likely to say yes to it—even without insurance.

Bundle EMS Into Rehab Programs

Offering EMS as a standalone service makes it easier for patients to skip it. Instead, build comprehensive packages that combine EMS with physiotherapy, gait training, or occupational therapy.

For example:

- 2-week post-operative rehab bundle: Includes 5 EMS sessions + 3 manual physio sessions

- Amputee readiness plan: 10-day EMS + prosthetic adaptation support + counselling

- Stroke recovery phase 1: Daily EMS for motor reactivation + speech support + home exercises

These bundled solutions shift focus away from paying for EMS and towards paying for results. That change in framing makes your offer more appealing—and justifiable, even without insurance.

Offer EMS Trials or Demos

If someone has never used EMS, they won’t understand its value just by reading about it.

Let them feel it.

Offer a free or low-cost trial session, where the therapist explains how it works, demonstrates it safely, and answers all questions. When people see their muscles responding or feel pain relief immediately, they become more open to longer plans.

At Robobionics, we’ve seen this work firsthand with BrawnBand. Many users who were hesitant at first became long-term clients after just one session.

Partner With Employers and Corporates

Insurance companies may not cover EMS, but many progressive employers offer wellness reimbursements or preventive care budgets. This opens a door.

Reach out to HR teams in nearby tech parks, factories, or large offices. Offer corporate EMS wellness days, with free demos and doctor guidance. Present EMS not just as a rehab tool—but as something that reduces work absenteeism, improves productivity, and supports post-injury return to work.

Some companies may even agree to sponsor EMS sessions for injured employees through their internal health budgets.

Use Payment Plans and Subscription Models

High upfront costs are often a barrier. Businesses can remove that friction with flexible payment options.

Instead of charging ₹2,000 for a single EMS session, try:

- ₹5,500 for 6 sessions (valid for 2 weeks)

- ₹12,000/month for unlimited rehab access including EMS

- ₹999/session if booked as part of a subscription plan

For home-based EMS machines, offer EMI options, rent-to-own plans, or trials before full payment. Patients are much more willing to commit when risk is removed.

You can also explore partnerships with financing platforms or health lending apps to make this seamless.

Collect Data, Measure Progress

Many EMS machines can track progress—like muscle activation strength, frequency of use, or improvements over time. Use this data to show patients the impact of their therapy.

Even a simple before/after video of a limb moving more easily after a few sessions can build trust.

When people see proof of improvement, they stop seeing EMS as an extra cost—and start seeing it as a smart investment in their health.

Stay Connected With Patients After Discharge

Patients often stop therapy midway because they feel alone after leaving the hospital. Stay connected.

Send reminders for sessions. Offer phone check-ins or WhatsApp tips for using home EMS machines. Share motivational stories or progress reports.

The more supported patients feel, the more likely they are to continue—and refer others.

This patient loyalty also helps your business grow through word of mouth.

Train Your Staff Well

EMS is only as good as the person using it. Make sure your team—physiotherapists, prosthetists, even front-desk staff—understand the machine, its benefits, and how to explain it simply.

Role-play common patient objections. Practice explaining why insurance may not cover it, but why it’s still worth doing.

When your whole team speaks with confidence and care, patients trust more.

Will EMS Get More Coverage in the Future?

Growing Awareness of Rehab Needs

More doctors now understand the value of rehabilitation. They’re not just focused on surgeries or pills. They care about how well a patient can move, work, and live after treatment. EMS is playing a big role in this recovery journey.

With this shift, insurance companies are slowly starting to notice. As the demand for better rehab grows, insurers may include EMS in more policies—especially when it’s used for recovery after serious illness or injury.

Push From Hospitals and Physiotherapists

Leading hospitals and physiotherapy centers are already asking for better coverage. They want their patients to get full treatment, not just half. If more professionals speak up, the chances of EMS becoming part of standard health plans will go up.

Rise of Home Care and At-Home Rehab

After COVID-19, many health services moved into homes. People now expect care at their doorstep. This includes EMS.

If home-based rehab becomes more accepted, insurance companies might also start offering special plans or add-ons for it. A few top insurers are already exploring this option.

Custom Health Plans May Help

Some insurance companies let you customize your policy with extra features. These “riders” can include outpatient physiotherapy or rehab sessions. EMS could be covered under one of these riders if you choose the right plan.

So while EMS isn’t widely covered yet, the future looks hopeful. If patients, doctors, and insurers work together, this essential treatment may become more accessible for everyone.

Alternatives If Your Insurance Doesn’t Cover EMS

Ask Your Hospital About Packages

Some hospitals offer rehab packages that include EMS, physiotherapy, and doctor consultations. These are often cheaper than paying for each session separately. Ask your hospital if they have something like this.

EMI Options for Home Devices

If you’re buying a personal EMS device, check if the company offers EMI or rental plans. This makes it easier to afford without stressing your budget.

At Robobionics, for example, we offer solutions like BrawnBand, a portable EMS device built with medical-grade care in mind. We’re also happy to guide you on affordable rehab options.

Use Flexible Benefits from Work

Some companies give employees a wellness budget or reimbursement for health gadgets. If you work in an MNC or a startup, check if your employer offers any such benefits. EMS may qualify under “wellness” or “rehab” expenses.

NGO or CSR Support

A few non-profits and CSR (Corporate Social Responsibility) programs help patients who need rehabilitation tools like EMS. They don’t advertise much, so you may need to ask your doctor or hospital social worker for leads.

Save Tax with Section 80D

Even if insurance doesn’t pay for EMS, you may still get a small benefit under tax rules. If you pay for rehab, physiotherapy, or medical care for a family member, check if you can claim it under Section 80D (as preventive or outpatient care). Ask a tax advisor for help.

Final Thoughts: EMS is Essential, and Deserves Support

EMS isn’t just about muscle pulses or gadgets. It’s about helping people move again. It’s about dignity, strength, and hope—especially for those recovering from life-changing injuries or surgeries.

At Robobionics, we see this every day. We work with amputees, stroke survivors, and others on their healing journey. When EMS is part of that journey, the results are powerful.

But sadly, insurance support for EMS in India is still very limited. There’s confusion, lack of awareness, and sometimes—just outdated policy rules. That’s why we must all ask for better.

You can help. Speak up. Ask your insurer about EMS. Tell your doctor it matters. Share your story. The more we ask, the faster the change will come.

And if you or someone you love needs affordable, high-quality EMS solutions, we’re here for you. Our BrawnBand is made in India, doctor-backed, and designed to bring strength and confidence back to those who need it most.

You can even book a free demo with us to understand how EMS can work for your condition. Visit: https://www.robobionics.in/bookdemo/

Let’s build a future where recovery isn’t just possible—it’s also protected and supported by insurance.

Because everyone deserves a second chance to live strong.